Should I Get Travel Insurance For Morocco? Everything to Know

Whether you’re travelling to Morocco on a one-off trip or living a semi-nomadic lifestyle in the country, travel insurance should be a top priority before you head off. I’m someone who never travels abroad without travel insurance. It was drummed into me by my parents when I was young that it just wasn’t worth the risk.

After encountering several “challenging” situations while on the road, experience has taught me that travel insurance is (for me) a “must”. And after jumping around between lots of different providers over the years, I’ve now settled on my go-to: SafetyWing Nomad Insurance.

It’s simple and straightforward to understand exactly what’s included and they offer something for both short and long-term travellers. It’s also refreshing to find a travel insurance provider that allows you to visit multiple countries with the same policy – perfect if you’re someone who plans their adventures as you go.

One of the 180+ countries covered by SafetyWing Nomad Insurance is Morocco. And while it’s generally a safe country to explore, things can go wrong. This could be something as basic as lost luggage on your international flight there to medical evacuation while hiking Mount Toubkal.

In my opinion, it’s best to be prepared for any mishaps or emergencies that could arise during your travels. That’s where travel insurance comes in.

So what is the best travel insurance for Morocco? I’ve used a lot of different travel insurance providers over the years and have most recently settled on SafetyWing. I like that they have options for both short-term and long-term travellers AND that you can clearly compare pricing options on their website.

You don’t have to submit lots of personal information before finding out what it will cost you each month. Plus, there are optional add-ons depending on your needs and destinations.

In this article, I’ll discuss in detail why you should take out travel insurance for Morocco and explain what makes SafetyWing a standout provider for me.

Travelling to the Sahara? Discover everything you need to know about visiting this spectacular desert region here.

Disclosure: This article contains affiliate links, meaning I earn a small commission when you make a purchase. Affiliate links cost you nothing and ensure my content stays free!

Do you need travel insurance for Morocco?

Getting travel insurance for Morocco provides important protection in case you need emergency medical treatment, have to cancel your trip due to illness or lose your luggage.

The healthcare system in Morocco is not as developed as in many Western countries and you will be paying out of pocket if you end up with a medical emergency or being hospitalised.

As with any destination, petty crime happens and insurance can provide a financial safety net if you have expensive belongings stolen.

Additionally, extreme weather events and natural disasters like earthquakes (as occurred in Morocco in 2023) do occasionally impact the region and these can significantly disrupt travel plans. Without travel insurance, you’ll be paying out of pocket for additional accommodation or a last-minute flight back home.

Depending on the travel insurance policy you take out, the provider will have your back if any of these unpredictable events take place. In a best-case scenario, you never have to make a claim. But if disaster does strike, a travel insurance provider can lessen the blow by providing financial reimbursement.

Is travel insurance mandatory for Morocco?

No it isn’t. But considering the above-mentioned scenarios, I would highly recommend it. Personally, I don’t travel to Morocco (or anywhere outside of my home country where I have access to affordable healthcare) without travel insurance. It’s just not worth the risk.

Is travel insurance for Morocco a waste of money?

On the surface, travel insurance can seem like an unnecessary expense. After all, most trips go smoothly without incident and you have nothing to “show” for that upfront payment.

That being said, anyone who has been stuck overseas with a medical emergency or had their luggage lost by an airline can tell you that travel insurance is far from a waste of your hard-earned cash. When things go pear-shaped during your travels and you’re left with a hefty bill, you’ll be extremely grateful for the protection it provides.

Travel insurance acts as a safety net, protecting you financially when a worst-case travel scenario occurs. Illnesses, injuries, flight cancellations, lost baggage – these unfortunate events can derail a trip and rack up huge unanticipated costs. Without travel insurance for Morocco, you’d have to cover these expenses out of pocket and with no chance of reimbursement in the future.

But if you do take out travel insurance for Morocco, you can relax knowing you’re covered. Depending on your policy, the provider may pick up the tab for emergency medical treatment, reimburse you for lost luggage and even pays for hotels and meals if your flight is delayed or cancelled.

Thinking about renting a car and driving in Morocco? Discover everything you need to know here.

SafetyWing travel insurance for Morocco

SafetyWing is a travel insurance provider designed specifically for travellers, digital nomads and remote teams. While most travel insurance providers focus on short-term holidays and vacations, I love that SafetyWing offers affordable and highly flexible coverage for long-term adventurers (like me!) and that you can purchase the insurance before you venture off abroad or while you’re travelling.

SafetyWing Nomad Insurance offers coverage for more than 180 destinations around the globe (including Morocco) and there are two different coverage plans to choose from, depending on your needs. Once you select a policy, you can include optional add-ons like adventure sports coverage (which isn’t usually included in standard travel insurance policies).

Aside from purchasing Morocco travel insurance for a one-off trip, SafetyWing also offers a subscription model, with renewals every 28 days. This is perfect if you’re someone who is travelling long-term (or indefinitely) but still wants the peace of mind that travel insurance offers.

SafetyWing Nomad Insurance: Essential vs Complete Plans

Safetywing Nomad Insurance currently comes in two versions, Essential and Complete.

The Essential Plan is what most travellers would purchase for a one-off trip, while the Complete Plan is better for longer travels, digital nomads and people who simply prefer more coverage.

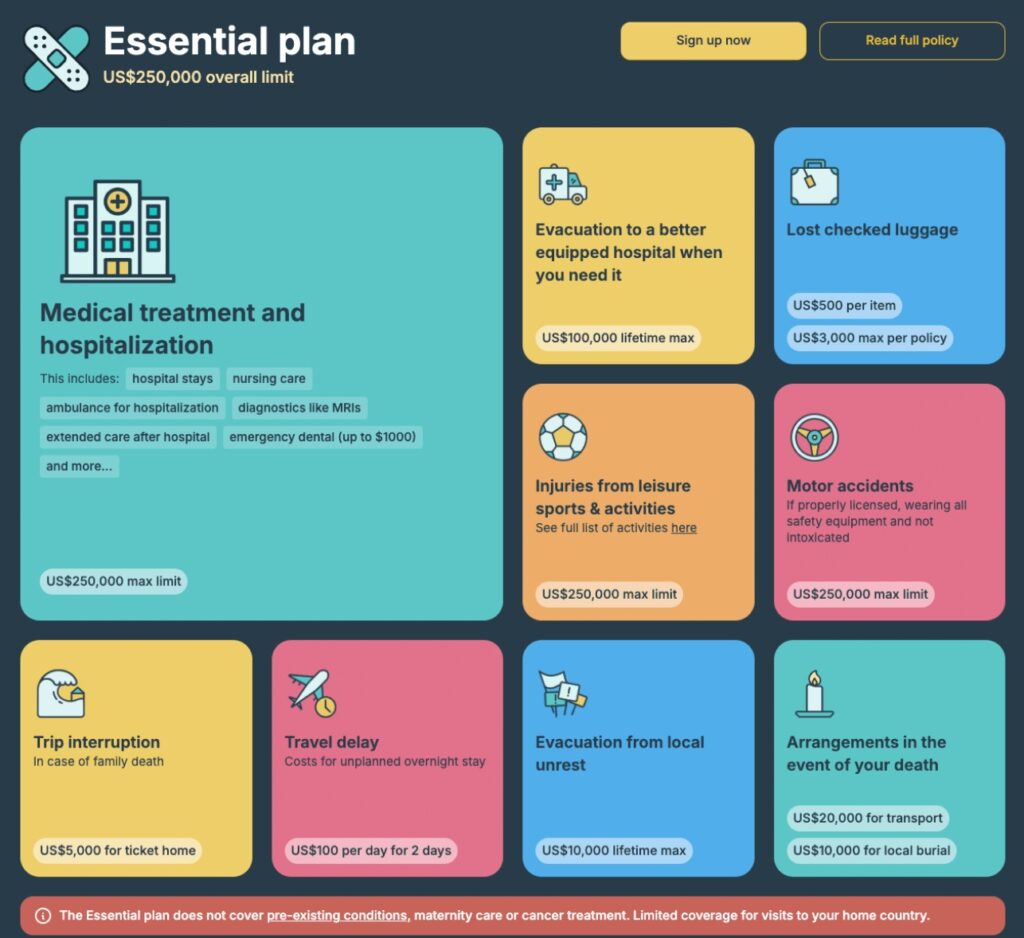

SafetyWing Nomad Insurance: Essential Plan Coverage

Best travel insurance for short-term travel

SafetyWing’s Essential Plan is what I opt for if I’m heading to Morocco (or anywhere else in the world) for a short-term trip. It provides coverage for unexpected medical issues while abroad, as well as things like travel delays and trip interruptions.

The Essential Plan includes a US $250,000 overall limit, which would probably see you through extended care if you were hospitalised abroad. It does not cover pre-existing conditions (these must be disclosed when purchasing a policy) while cancer treatments and maternity care are also excluded.

SafetyWing’s Essential Plan is also NOT accessible to travellers aged 70 years and over.

If you’re travelling to the United States, you’ll need to opt-in for the additional US coverage.

What’s covered with SafetyWing’s Essentials Plan (up to the limits detailed above):

- Medical treatment for unexpected injuries

- Emergency dental

- Hospitalisation

- Ambulance

- Motor accidents

- Injuries from leisure sports

- Lost checked luggage

- Trip interruption

- Travel delay

- Evacuation from local unrest

- Arrangements upon death

SafetyWing Nomad Insurance: Complete Plan Coverage

Best travel insurance for digital nomads and long-term travel

If I’m travelling long-term (for several months or more), then I usually opt for SafetyWing’s Complete Plan. In my mind, it takes the place of the health coverage I have back home and comes with a US$1,500,000 overall limit.

SafetyWing’s Complete Plan includes everything covered in the Essential Plan, plus routine and preventive care, cancer treatments, maternity care and wellness therapies. There’s also an opt-in for dental treatments so you can stay up-to-date with preventative care.

As with the Essentials Plan, the Complete Plan doesn’t cover pre-existing conditions and it isn’t available to travellers aged 64 years and over.

If you’re travelling to the United States, Singapore or Hong Kong for more than 30 days, you’ll need to opt-in for the Hong Kong, Singapore & US add-on.

What’s covered by SafetyWing’s Complete Plan (up to the limits detailed above):

- Medical treatment for unexpected injuries

- Emergency dental

- Hospitalisation

- Ambulance

- Motor accidents

- Injuries from leisure sports

- Lost checked luggage

- Trip interruption

- Travel delay

- Trip cancellation

- Stolen belongings

- Evacuation from local unrest

- Arrangements upon death

- Doctor and specialist visits

- Routine checkups and preventative care

- Wellness therapies with a $60 co-pay

- 10 psychologist/ psychiatrist visits per year

- Cancer tests and treatments

- Maternity care

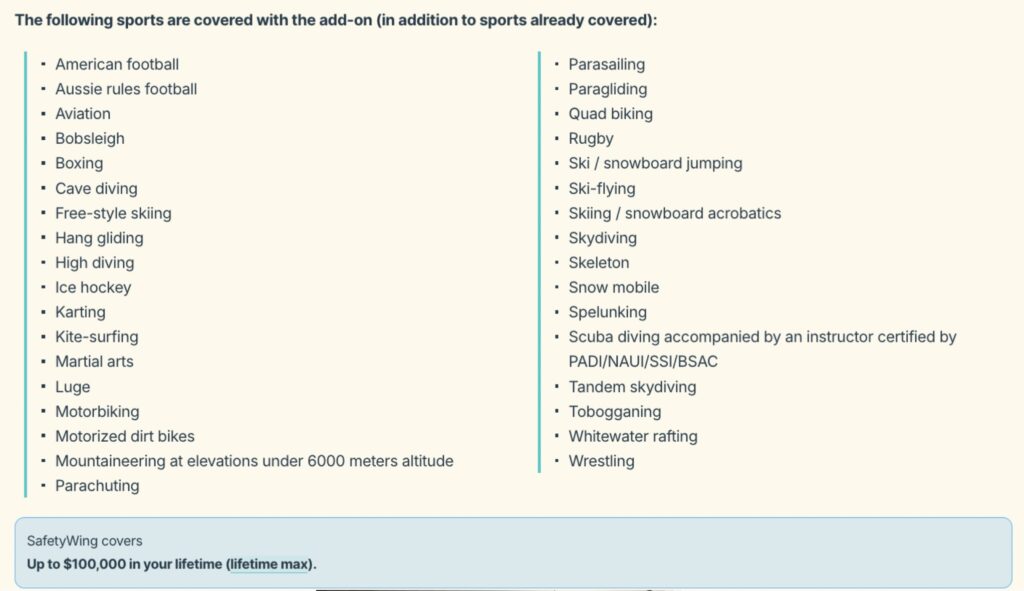

Adventure sports add-on

While both the Essential and Complete plans cover some leisure sports, adventure sports are an add-on. If you plan on going kite-surfing, paragliding or sky-diving in Morocco, these are all classified as “adventure sports”. Quad-biking, which is really popular in Agafay and the Sahara Desert, is also considered an “adventure sport”. You’ll find a full list of “adventure sports” (as classified by SafetyWing) below.

Your SafetyWing travel insurance policy will NOT cover you for these activities UNLESS you include the Adventure Sports Add-On when purchasing your insurance. Before you take out travel insurance for Morocco, think about the types of activities you might want to participate in and ensure you are covered for them.

Electronics theft add-on

Another optional add on is for electronics, such as laptops, tablets and cameras. If you’re someone who travels with a lot of gear that’s integral to your life and work, then this is highly recommended. You can claim up to $1000 USD per stolen item, up to a maximum of $3000 each year. Keep in mind you must have proof of ownership (keep your receipts!) to make a successful claim.

Dental coverage add-on

With the Complete Plan, you can opt for a dental add-on, which includes up to $1000 per year for dental care abroad. This includes everything from routing cleanings to major dental procedures and surgeries. Be aware that you can only get a maximum reimbursement of $250 during the first 6 months you are covered – dental treatments in the second 6 months are eligible for the remaining $750.

Please read:

It’s essential that you read the fine print before purchasing any travel insurance policy to ensure your belongings and chosen activities are covered. When making a claim, you will need to provide all required and relevant documents, such as doctor letters, hospital receipts and proof of ownership for electronic goods. Without these, SafetyWing can’t approve a claim.

Morocco travel insurance costs with SafetyWing

As with any travel insurance for Morocco, SafetyWing Nomad Insurance requires an up-front payment (or recurring subscription) that may or may not end up paying for itself, depending on whether you need to make a claim. But the peace of mind it offers is (in my opinion) worth the price alone.

Top tip:

As a general rule of thumb, travel insurance for Morocco costs more the older you are. Keep this in mind when budgeting for your trip.

With the Essential Plan, they have four different pricing tiers: 20-39, 40-49, 50-59 and 60-69, with kids under 10 covered for free when travelling with a covered adult.

With the Complete Plan, there are five different pricing tiers: Under 18, 18-39, 40-49, 50-59 and 60-64.

If you’re opting for adventure sports or electronics theft add-ons, expect to pay an extra $10 USD per month for each. Additional coverage for the United States, Hong Kong and Singapore will depend on your age bracket – you’ll pay more for these the older you are.

With SafetyWing Nomad Insurance, you can explore Morocco with confidence, knowing you have a safety net if things go unexpectedly awry. It gives peace of mind that you will receive (and be able to afford) any medical treatment you need while abroad and won’t be left out of pocket if a travel disaster strikes.

The premiums for SafetyWing Nomad Insurance are also relatively affordable, especially compared to the five- or six-figure hospital bills you could face abroad. For a know amount of money each month, you can protect yourself from potential financial catastrophe.

Travel insurance gives you the peace of mind that if the worst happens, you won’t be left footing the bill. It’s a classic case of “better safe than sorry”. So my suggestion is not to let the upfront cost dissuade you. One day, far from home, you may find yourself very grateful you decided to take out a travel insurance policy after all.

FAQs about travel insurance for Morocco?

Is travel insurance mandatory for Morocco?

No, travel insurance isn’t compulsory for Morocco but it’s highly recommended. It provides financial protection in case you require emergency medical care, need to cancel your trip due to illness or lose your luggage. Travel insurance offers peace-of-mind that you will be financially covered in a worst-case scenario.

Do you need travel insurance for Morocco?

Taking out travel insurance for Morocco is highly recommended as it offers financial protection in medical emergencies or when travel plans are forced to change. It may also provide reimbursement if your belongings are lost during international and/or domestic flights

Like any other destination, petty crime can occur in Morocco and having insurance can help if your belongings are stolen. Additional, natural disasters such as earthquakes (like the one that happened in September 2023) or severe weather conditions can occasionally impact the country, leading to disruptions in your travel plans.

Depending on the travel insurance policy you choose, your provider may support you if any of these unforeseen events occur.

What is the best travel insurance for Morocco?

The best travel insurance for Morocco depends on several things, including the level of coverage you want, the duration of your trip and your age. While some travel insurance providers offer strictly medical coverage overseas, others include reimbursements for travel delays, stolen belongings and lost luggage.

SafetyWing Nomad Insurance offers two different coverage options – one designed for short-term travel and the other for long-term adventures. While their Essentials Plan provides coverage for hospitalisation, lost luggage, travel delays and motor accidents, the Complete Plan adds in routine and preventive care, cancer treatments, maternity care and wellness therapies.

PLAN YOUR TRIP WITH MY FAVOURITE RESOURCES:

Find hotels via Booking

Book tours and attractions via Viator or GetYourGuide

Find a rental car via Discover Cars

Book flights via Kiwi or Booking

Search for buses and trains via 12Go or Omio

Get travel insurance via SafetyWing

Buy a digital eSIM with Airalo

By purchasing through my links, you’ll be supporting my website at no additional cost to you

About Me

I’m Malika, a global traveller who first visited Morocco in 2014 before marrying a local and settling down in a little village on the Atlantic coast. Over the years, I’ve developed an intense love for Morocco, its incredible landscapes, storied cities and the exceptionally generous hospitality of its people.

Malika in Morocco is a place to share my years of experience exploring the country, from north to south and from the Atlantic Ocean to the Sahara Desert. As a resource for travellers visiting Morocco, I want to encourage others to experience this captivating destination the way they desire, whether that’s independently or under the expert guidance of local tour operators.

I believe strongly in supporting responsible and sustainable tourism initiatives while inspiring travel experiences that are life-impacting and mutually beneficial for both travellers and locals.

-

9 Best Family Hotels in Marrakech for a Kid-Friendly Stay

Looking for the best family hotels in Marrakech? Explore this curated collection of riads, resorts and apartments that cater to travellers visiting Morocco with kids. There’s no denying it – Marrakech is an incredible destination and one of Morocco’s most popular places to visit. But it can also be an assault on the senses and…

-

Essential Travel Guide to Safi: Morocco’s Ceramics Heartland

Looking for the best things to do in Safi or highly recommended places to stay? Discover the ideal time to visit, tips for getting around and the best tours in this essential travel guide to Safi. Located halfway between the seaside cities of El Jadida and Essaouira, Safi is a historic coastal city that remains somewhat…

-

8 Best Luxury Hotels in Fes: Morocco’s “Cultural Capital”

Looking for the best luxury hotels in Fes? Explore this curated collection of high-end stays, including beautifully restored riads and modern retreats. Hidden gems and historic treasures await in Fes, Morocco’s cultural capital. Stays here are all about wandering through the maze-like medieval medina, uncovering artisanal wares in the souks and marvelling at the centuries-old…

-

11 Amazing Hotels in Taghazout: Morocco’s Surfing Heartland

Looking for the best hotels in Taghazout or the best places to stay in Tamraght? Discover inspiring accommodation options along Morocco’s surf coast for all budgets and travel styles. Taghazout is the place you go if you’re seeking endless waves, daily yoga sessions and cafes serving health-conscious food. It’s a laid-back Amazigh village between Agadir…

-

10 Luxury Hotels in Essaouira for a High-End Coastal Escape

Looking for the best luxury hotels in Essaouira? Explore this curated collection of high-end stays, including beautifully restored riads, dreamy villas and modern retreats. Drenched in sunshine on Morocco’s Atlantic coast, the easygoing town of Essaouira exudes a carefree spirit. Honestly, it feels worlds away from the chaotic energy of Marrakech. I simply love visiting…

-

Meet the indigenous Amazigh people of Morocco

Often referred to as “Berbers”, the Amazigh people of Morocco are a diverse collection of ethnic groups Indigenous to North Africa. While they are concentrated primarily in the Maghreb region (Algeria, Libya, Mauritania, Tunisia and Morocco), they can also be found in northern Mali and northern Niger. Predating the arrival of Arabs in the region,…